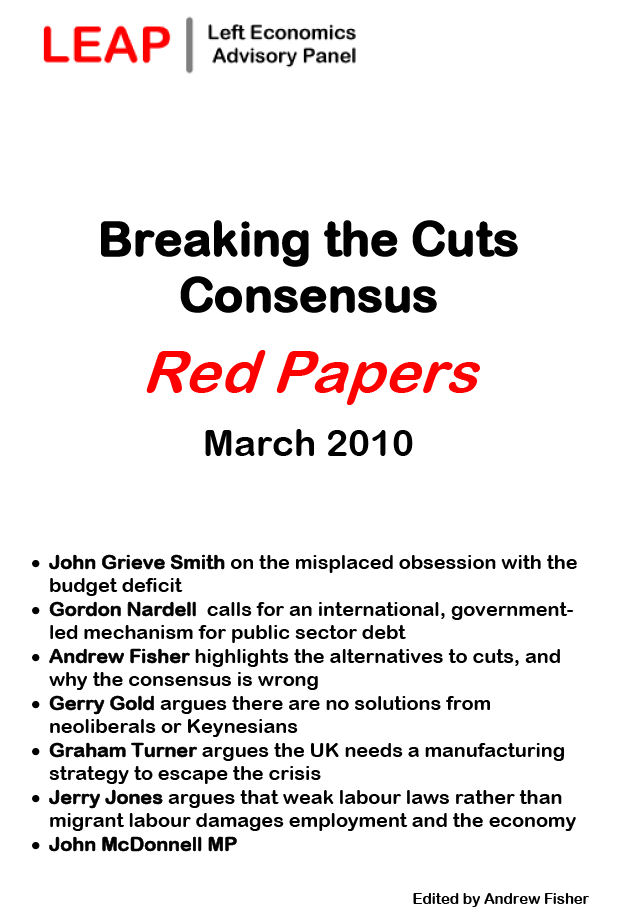

The March 2010 LEAP Red Papers: Breaking the Cuts Consensus are published today in advance on the Budget Statement on Wednesday 24th March.

In this edition of the papers, John Grieve Smith argues that the pre-election cuts consensus is driven by misplaced obsession with the budget deficit, and that such cuts would be damage the economy. The 'misplaced obsession' could be countered by an international, government-led mechanism for pricing and trading public sector debt, argues Gordon Nardell.

An alternative to the cuts consensus, based on tax justice and public ownership, is argued for by Andrew Fisher, while Gerry Gold explains why neither the solutions offered by neoliberals nor Keynesians can solve the global crisis.

Graham Turner argues that the crisis in the UK is exacerbated by the decline of manufacturing, on contrast to other countries that have had a clear manufacturing strategy, while Jerry Jones tackles another election issue – migration – arguing that trade union rights are the solution to exploitation and under-cutting.

As John McDonnell MP concludes, no party is adequately addressing these issues because none want a more democratic system

Download the papers in full.