In total £70bn is being made available to banks at reduced interest rates to lend on to small and medium-sized businesses, as well as individuals.

However, results announced yesterday for the last three months of 2012 show that bank lending fell by £2.4 billion. So despite giving cheap money to the banks, lending fell why?

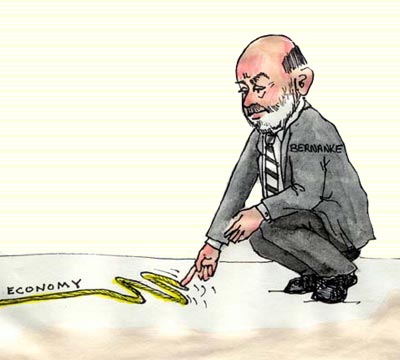

However, results announced yesterday for the last three months of 2012 show that bank lending fell by £2.4 billion. So despite giving cheap money to the banks, lending fell why?The answer is simple: demand. With the average wage growing by just 1.3% in the last year - and inflation at 3.3% - people's living standards are falling, and have been for over four years now. You can supply as much cheap credit as you like, but if there's not sufficient demand then it's just pushing on a piece of string.

As I told the Morning Star:

"When people's incomes are being constrained and job insecurity remains there is no confidence to borrow money, even at marginally reduced rates.Consumer spending in the retail sector fell 0.6% in January from December which itself saw a 0.3% fall in sales. The January 2013 figure is also down 0.6% from January 2012. With wages lagging inflation a sustained upturn is highly unlikely to materialise.

"Likewise businesses know that consumers are spending less and are not borrowing to invest in expanding their operations,"

That's why it's encouraging that members of the PCS union have voted to strike - primarily over pay - but this needs to be widespread and result in inflation-busting pay awards to boost demand.

Even some Tories are reaching the conclusion that the supply-side is not the problem. Step forward the Mayor of London's new economics adviser Dr Gerard Lyons, writing in the Telegraph today:

"The economy is suffering from a lack of demand. There needs to be more spending by the Government on both infrastructure and construction and people and firms with the ability to spend need to be given the confidence to do so"

On the business side, some have pointed to statistics showing that the number of small business loans rejected by the banks has quadrupled since the crisis - they say this is evidence of unmet demand. That may be true to a limited extent, but it ignores three salient factors:

- Businesses are now making more loan applications to cover (what they hope are temporary) shortfalls, rather than to invest

- Banks, whose reckless lending practices played a major role in causing the crisis, are now more rightly more cautious

- The same business plan in 2006/07 at a time of high employment and rising real wages was a lot more attractive to invest in than it is in 2012/13

I expect that lending via the scheme will pick up marginally in 2013, as from the low base borrowing at reduced interest rates will be more attractive to some businesses and to some people. However, increases in FLS lending are not likely to be enduring until something happens to increase demand.

No comments:

Post a Comment